Research in Crisis

A FAIR Way Forward for Federal Research Funding

It is the government’s investment in research that leads to cures, transformative technologies and new industries that save lives. In recent months, however, federally sponsored research at universities, medical schools and non-profit research institutes like Sanford Burnham Prebys has been upended by a series of executive orders and directives from the Trump administration and federal agencies.

The proposed cap is profoundly damaging to the continued pursuit of science and knowledge, but there is a remedy. The Financial Accountability in Research (FAIR) model introduces a modern, structured framework for budgeting and funding the full range of costs associated with federally sponsored research and ensuring accountability for how those monies are spent. It is brilliant in both scope and simplicity, enhancing transparency and accountability. Research expenses are more understandable, more visible and more explicit — all claims of concern by the Trump administration.

FAIR was developed by the Joint Associations Group (JAG), a coalition of higher education and research organizations nationwide. JAG’s Subject Matter Expert team included representatives from large and small public and private universities, independent research institutes, academic medical centers, hospitals, private foundations and industry.

More than 250 research institutions have endorsed the FAIR model.

The process involved more than 10,000 participants in national town halls and webinars, hundreds of written comments, extensive model testing by more than 170 institutions, as well as conversations with members of Congress and the administration. This broad engagement ensures that FAIR reflects the operational realities of all types and sizes of research-performing organizations.

The next few weeks will be critical to determining the fate of FAIR model. With just 14 legislative days in September, Congress will need to complete and approve multiple appropriations bills. The FAIR model is part of this process. It has broad support in the nation’s research community and among key U.S. representatives and senators.

Here’s what you need to know about the FAIR model:

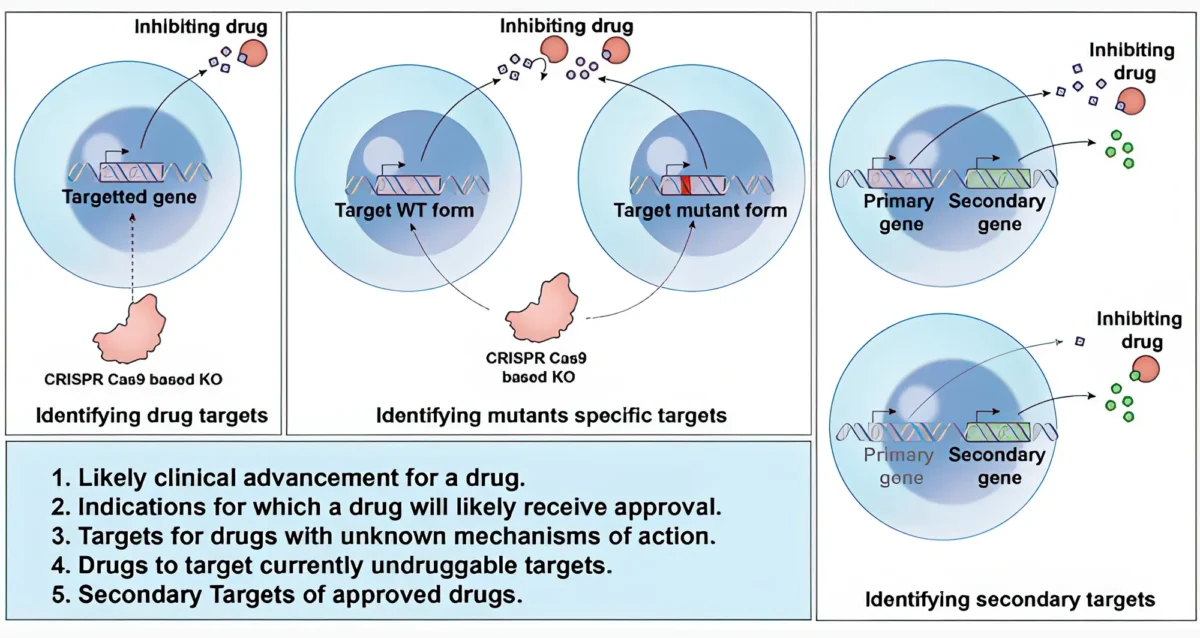

- It is a new approach, abandoning outdated and vague terms like indirect costs in favor of specific details about actual costs necessary to perform a research project. These defined costs are visible to everyone, from government officials to taxpayers. The approach promotes best practices and efficiencies, in particular aligning institutional investments with government research priorities.

- The FAIR model incorporates systems already effectively used in industry and private enterprise to clearly track costing categories — and make explicit how monies are spent. This ensures research performance support is tailored and tied to specific projects.

- The model is adaptable to institutional size and type, from large universities to smaller non-profit research institutions. It has tiers of reporting and infrastructure designed to match the resources of different institutions.

In this moment, much of U.S. research is at a standstill, paralyzed by unpredictability. Science that stands still falls behind. The FAIR model points a smart path forward. It should be embraced, approved and adopted. It will help ensure that the United States continues as the global leader in science and medicine, now and in the future.

Scroll down to the Advocacy section on this page to learn how to contact your federal and state representatives in support of the FAIR model, and discover how you can directly help advance scientific research.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Protecting the Future of Biomedical Research

The NIH’s proposed cap on indirect costs threatens the foundation of scientific progress, putting research institutions, scientists, and public health at risk.

Below, explore key perspectives on this issue, including:

- Letters from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

- Letters from local community members, as well as voices in the media

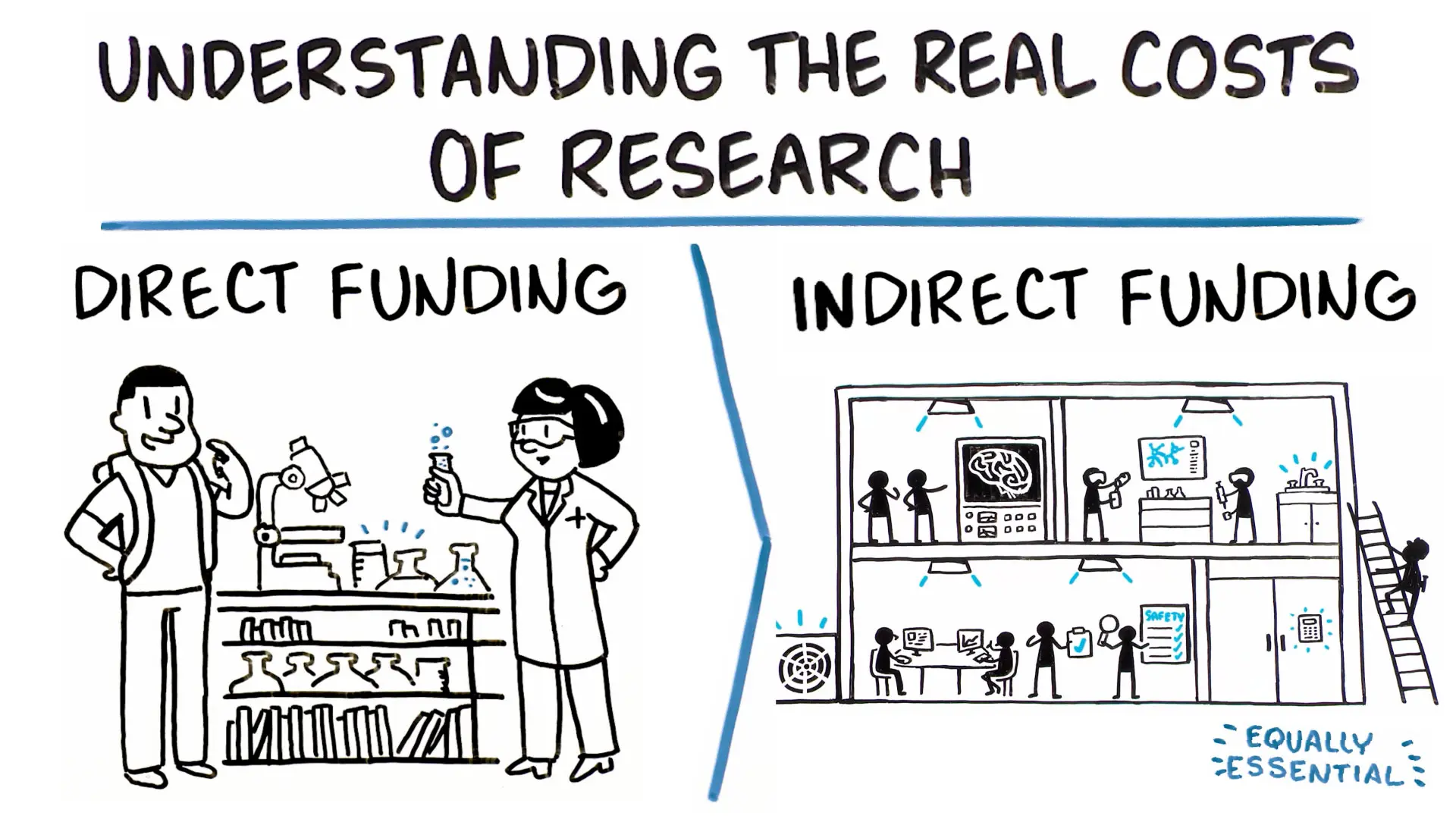

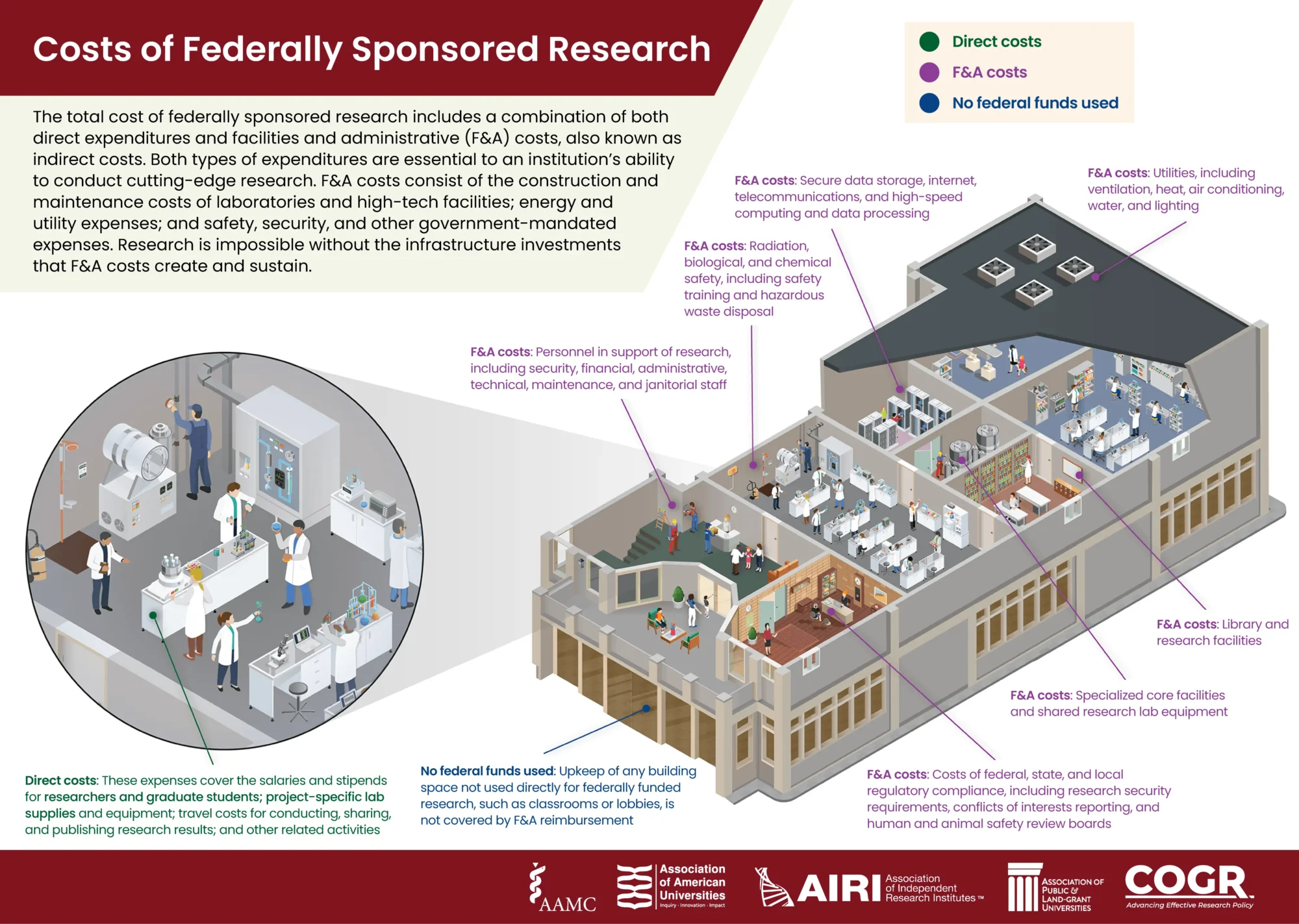

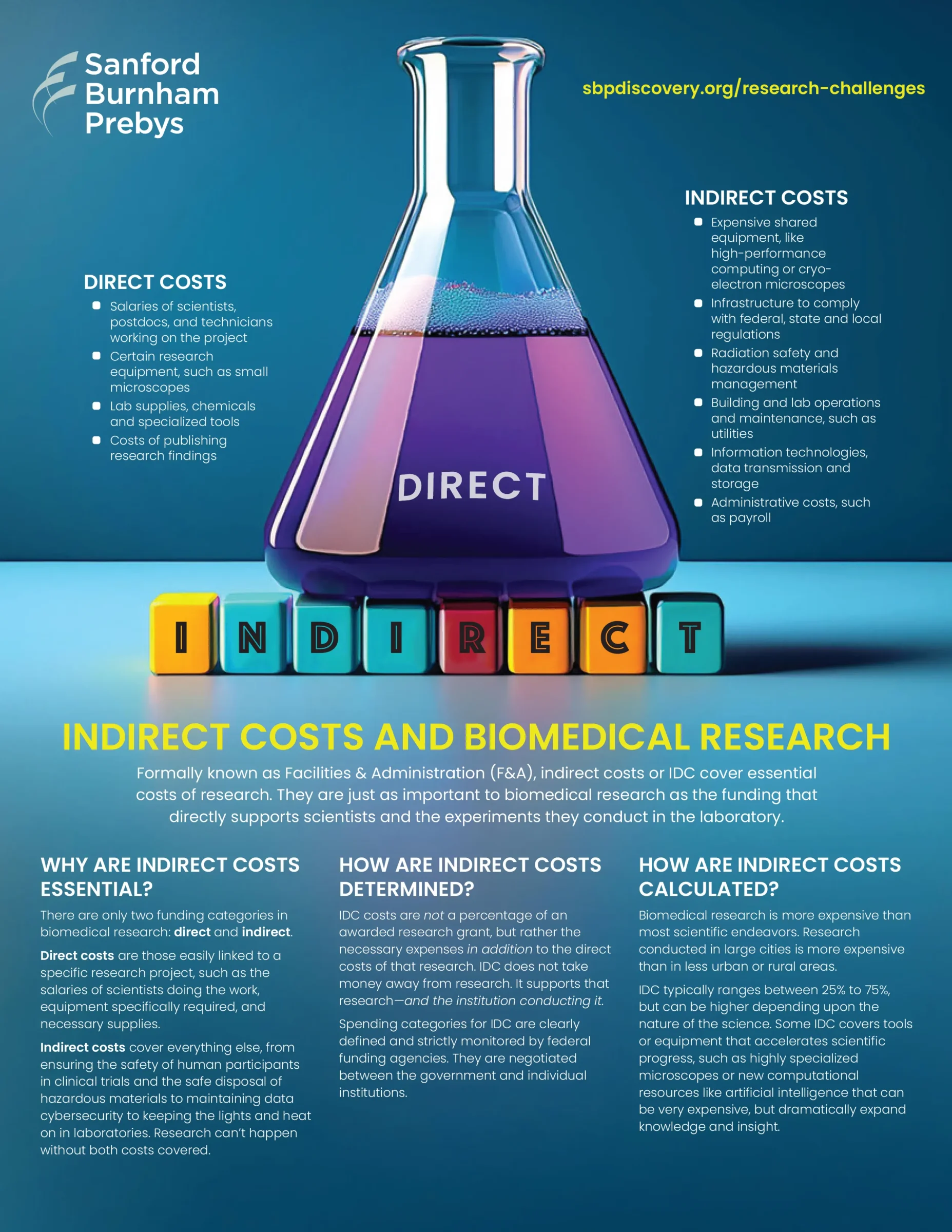

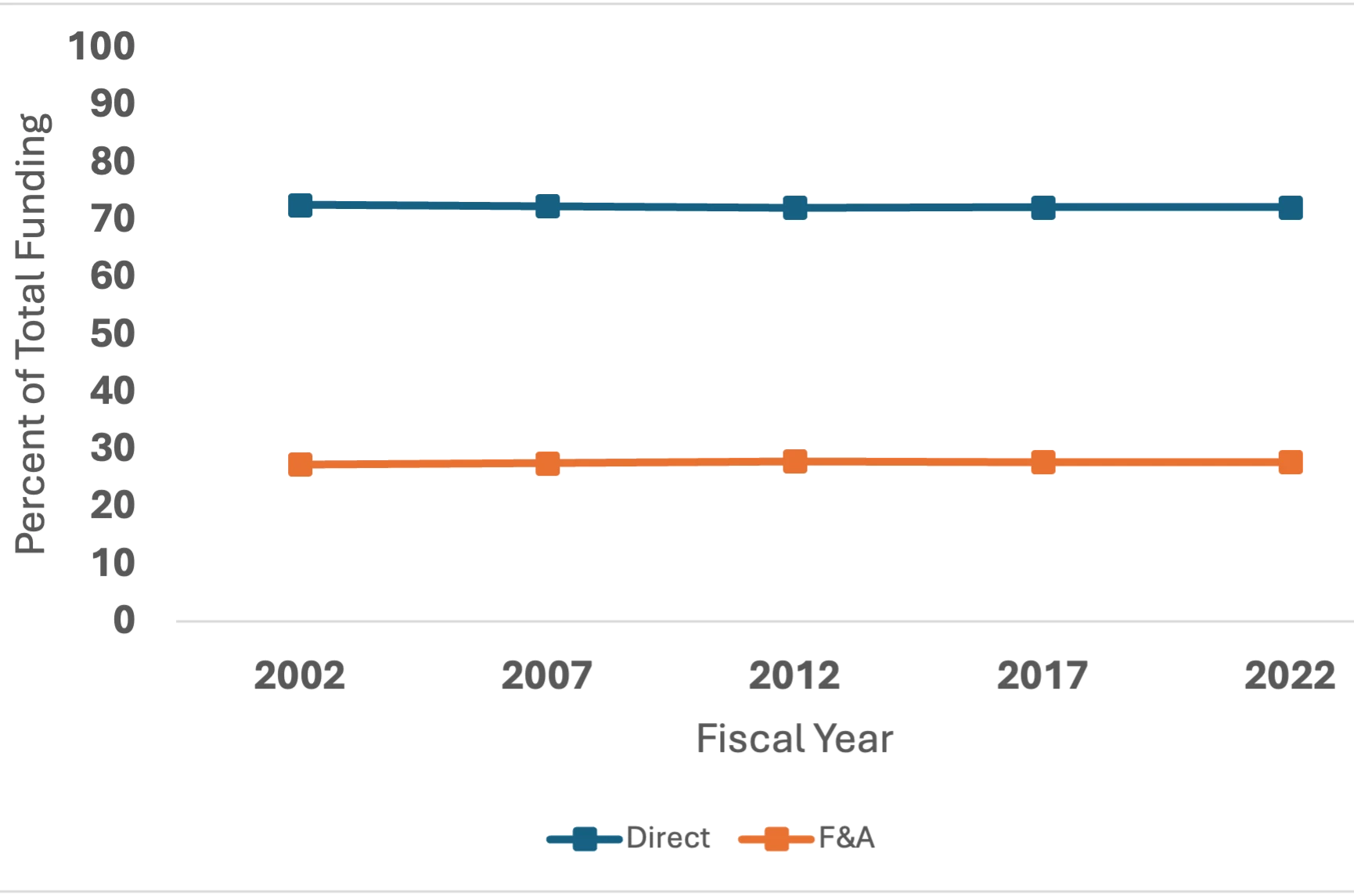

- Infographics explaining direct vs. indirect costs

- Frequently asked questions about facilities and administrative costs

- Funding statistics that highlight the impact of biomedical research

- A list of government representatives engaged in this critical fight

Together, we must advocate for sustainable funding to ensure continued innovation and discovery.

News and Opinion

Letters

Letters from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

Science Marches On Because It Must Never Go Backward

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

“At the end of the day, it’s not about what you have or even what you’ve accomplished… It’s about who you’ve lifted up, who you’ve made better. It’s about what you’ve given back.”

–Denzel Washington

With the challenges facing the research enterprise, it can be easy to lose sight of what we work to achieve every day. Over the last few months on this page, we have chronicled, explained and debated the issues facing research today, from the importance of indirect costs to the exodus of young scientists to other countries and other careers.

Today, I would like to offer a reminder of why supporting research is so vitally important.

At Sanford Burnham Prebys, we strive to better understand the most challenging diseases and to find new therapies to cure them. This is our core mission; this is who we are. And over the last two years, we have been re-imagining the research enterprise and investing in the science and people, including the recruitment of more than a dozen upcoming and established new researchers.

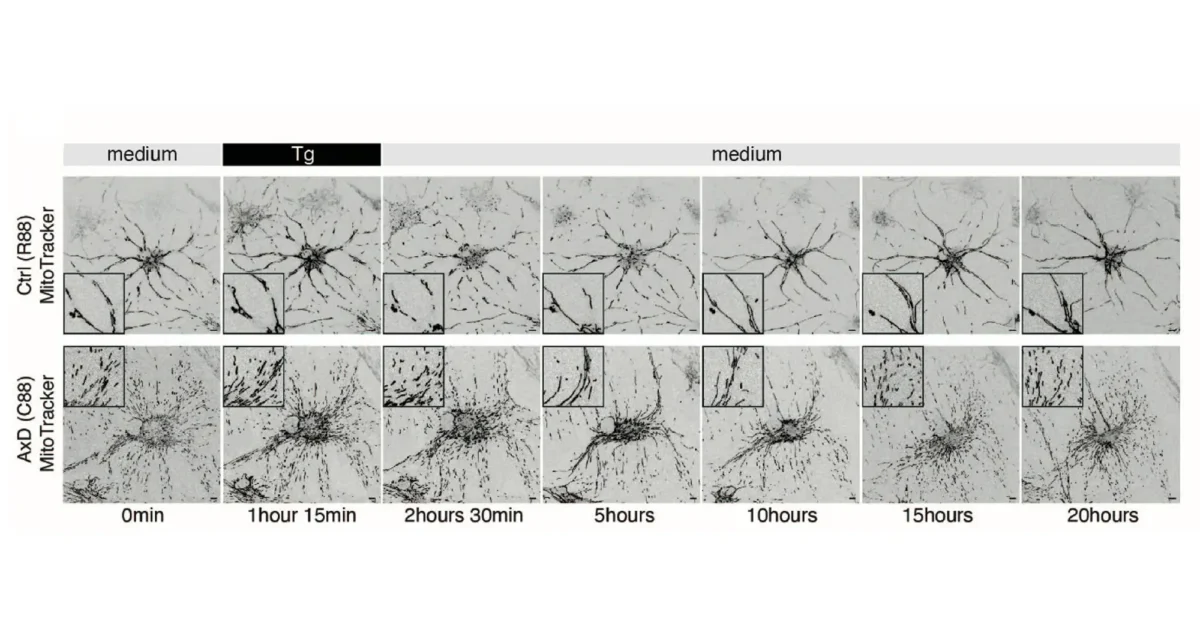

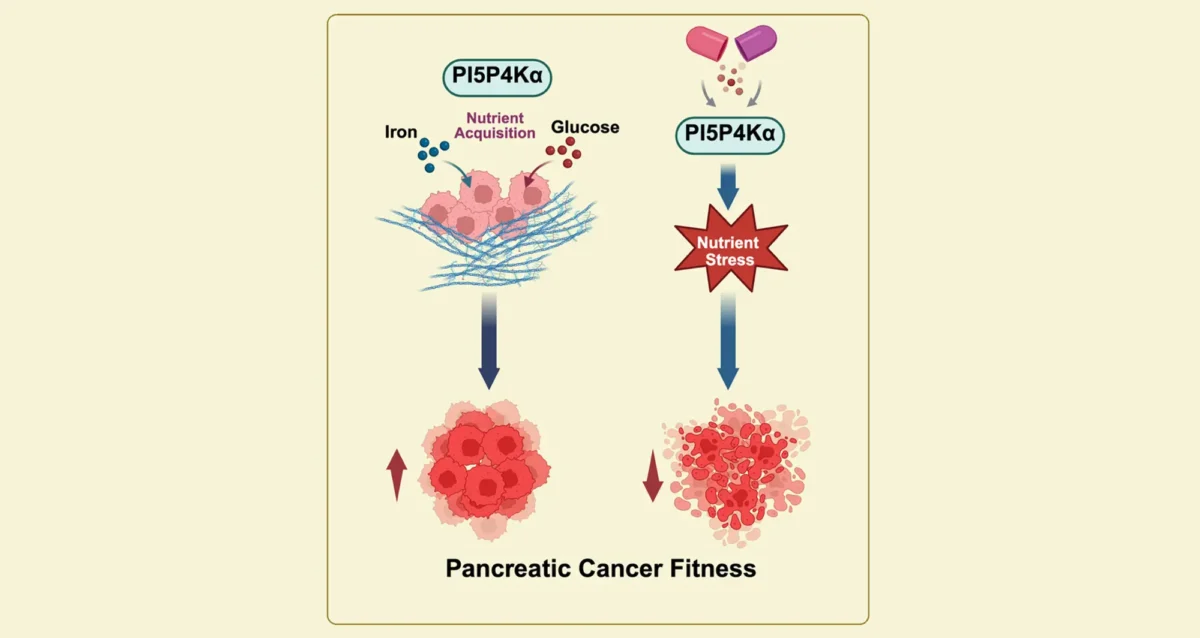

We are structured to focus on four disease areas — cancer, cardiovascular, neurological and metabolic—choosing to address some of the most daunting illnesses, such as pancreatic and brain cancers, congenital heart conditions, Alzheimer’s disease (AD) and liver disease, which in some form affects nearly half of all American adults.

We believe that the fundamental discoveries we make about these diseases may have broader import, that what we learn about the underlying pathology of pancreatic cancer, for example, offers lessons for other types of cancer. Or that a novel drug compound developed at the Prebys Center for Chemical Genomics for a specific purpose may also provide other therapeutic possibilities, perhaps previously unimagined.

These efforts are real and ongoing. Examples abound:

- Of developing an artificial intelligence tool that reliably predicts tumor response in individual patients for specific therapies based on single-cell datasets;

- Of fusing two immune system proteins to create a new method of generating antibodies and new opportunities in drug discovery;

- Of discovering that the mechanism of drug that blocks an enzyme required by the HIV virus to replicate also appears to reduce the risk of developing AD.

Good science requires millions of dollars, thousands of hours and tens of years to translate an hypothesis into a new drug or therapy available to patients. It requires the support and advocacy of patients, their families and the public.

I encourage you to review these pages and to contact us to learn how you can support and advocate for science.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Science Will Find a Way

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

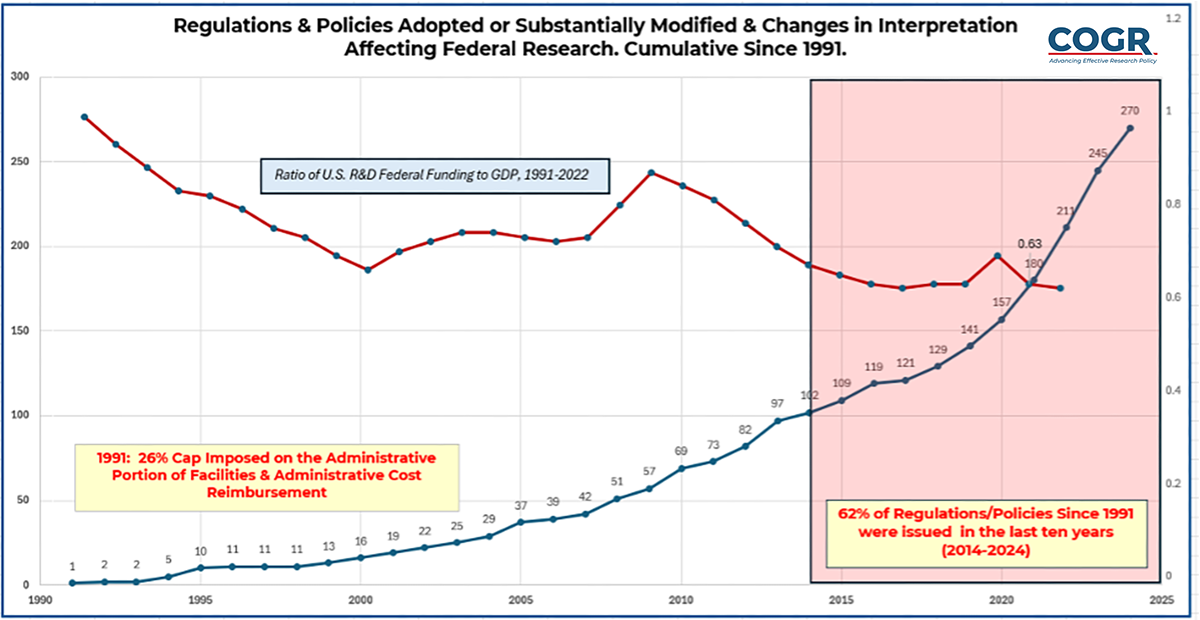

No one thinks the current system for funding indirect costs (IDC) for scientific research is perfect. It’s the result of 80 years of expansive and visionary federal support of science. In that time, original goals and practices have morphed to meet changing needs. The system has evolved to become increasingly efficient at the expense of transparency.

IDC is a big bucket term that includes all of the expenses of research not directly associated with a specific project or program, everything from infrastructure required to meet federal, state and local regulations and safety requirements to administrative costs, insurance and utilities.

IDC is paid by the agency funding the research grant to the research institution or university performing the research. It is a percentage above and beyond the direct costs required to fund approved research, such as the salaries of scientists, scientific equipment needed and lab supplies

IDC rates are negotiated between organizations and federal agencies. They vary from, say, 30 percent to 70 percent of a grant’s direct costs. They are regularly reviewed and institutions are subject to regular audits.

The benefit to research institutions is clear: They can identify their relevant expenses and seek an IDC rate that sustains their work and mission. No one knows better what is needed to do the job than the institution doing the job. It is a model of logic and efficiency.

However, since January at least four federal agencies have sought to enact a flat IDC funding cap. They are the powerhouses of research funding: the National Institutes of Health (NIH), the U.S. Department of Energy, the National Science Foundation (NSF) and the U.S. Department of Defense. All seek to cap IDC at 15 percent — an existential threat. Three agencies have been blocked, at least temporarily, by the courts. On June 20, a federal judge struck down the NSF action, ruling that it was “arbitrary and capricious” and didn’t align with federal law or regulations.

The Trump administration asserts that the scientific enterprise in this country is spending too much money with too little accountability — and not enough to show for it. Through the NIH, NSF and other agencies, the administration has cancelled thousands of research grants totaling billions of dollars, claiming the country was receiving “diminishing returns” on the government’s investment in science.

The contention is demonstrably ridiculous. U.S. science has long been preeminent in the world, the epitome of research excellence and achievement, from basic understanding of human biology to drug development to new technologies like genomic sequencing and artificial intelligence. Many, perhaps the majority, of grants have been terminated for reasons having much more to do with politics than actual science. Unaddressed, we will suffer the consequences for years to come.

But buried within the administration’s irresponsible and arbitrary allegations is a single cogent point: What science funding has achieved in terms of efficiencies; it has lost in terms of transparency.

From the outside, it can be impossible to see or understand how, when, where and why research monies are spent. Critics of the current IDC system can’t see the details. They may have little understanding of the complexities. They assume the worst — even if they lack evidence to support their claims.

This month, a coalition of organizations representing universities, medical centers and research institutions like Sanford Burnham Prebys proposed a new approach called the Financial Accountability in Research (FAIR) model.

It reconfigures federal research funding into three components:

- Research Performance Costs, which are expenses linked to project-specific activities.

- Essential Research Performance Support are expenses necessary to carry out research and can be linked to a given project, such as regulatory compliance, information services, facility space, utilities and operations.

- General Research Operations are expenses that include institution-wide infrastructure and services necessary to support and conduct research, but which can’t be practically allocated to a given project. Examples include onboarding, payroll, procurement and general administration.

Under this model, institutions would be subject to new standards to increase transparency and accountability, said Kurt Marek, PhD, chief research development officer at Sanford Burnham Prebys who also spent many years as a director at NIH.

“The FAIR model represents a new approach to funding science — one that ensures the true costs of research are transparently included in project budgets. The model provides accountability to taxpayers and supports ‘gold standard science’ that will maintain America’s preeminence in science and technology for decades to come.”

It remains to be seen how the Trump administration and Congress will respond to the proposal. Adoption would require a change in dogma and some reworking of current federal guidelines. The model is a map forward.

Science is fundamentally about exploring the unknown, but these days of funding uncertainty are antithetical to the enterprise. We need to fully get back to work, knowing that our missions to increase human knowledge and wellbeing are sustainably funded.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

One Flu Over the Cuckoo’s Nest

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

It’s safe to say that researchers and research institutions in the United States were not prepared for the breadth and depth of the Trump administration’s assault on science, from radical cuts in funding support to eliminating diversity and opportunity to driving scientists, young and older, to change careers.

Now, it seems, the rest of us may be less prepared for the next pandemic, or the next flu season.

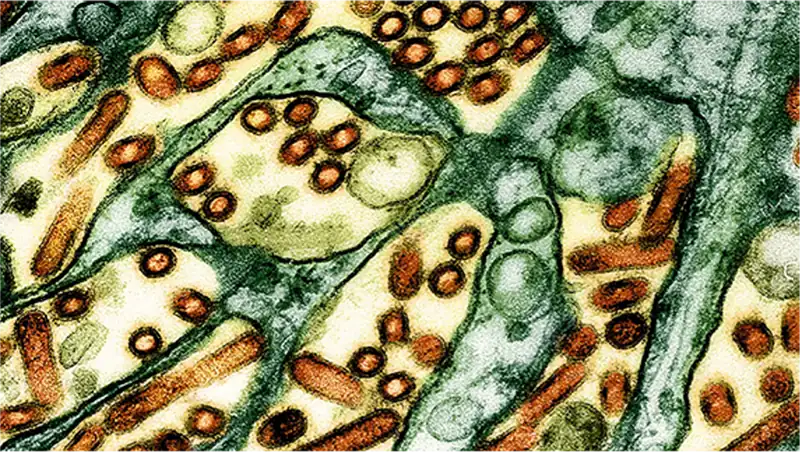

In May, the Department of Health and Human Services (HHS) notified the pharmaceutical company Moderna that it was canceling a nearly $600 million contract with the company to develop, test and license vaccines for flu subtypes that could trigger future pandemics, including the H5N1 bird flu virus, of which there have already been 70 confirmed cases in the U.S., and one death.

Currently, the bird flu primarily afflicts animals, mostly cattle and poultry, with humans becoming infected through close proximity to infected animals. There are no known cases of person-to-person spread, at least in the U.S.

But that will likely change because viruses notoriously change, constantly evolving to improve their abilities to move from host to new host, to infect and survive. H5N1 has the potential to be highly contagious. And what most worries public health officials is that the H5N1 virus is notably virulent. It has a case-fatality rate (CFR) of 50 percent, meaning that if there are 100 confirmed cases of the disease, 50 will result in death.

Between 2003 and February 2025, the World Health Organization recorded 972 confirmed cases of H5N1 influenza in humans, leading to 468 deaths.

CFRs vary over time and by place. They are dynamic. In the early stages of the COVID-19 pandemic, for example, the CFR for the SAR-CoV-2 virus was upwards of 20 percent — one in five persons infected died — but as understanding, testing and treatments improved and the virus evolved to be less pathogenic but more infectious, the CFR dropped to as low as 0.7 percent.

But that’s small solace in the beginning. COVID-19 killed millions in the year or so before effective treatments emerged and more importantly, vaccines like those produced by Moderna and Pfizer became widely available. A bird flu pandemic would be comparably devastating, maybe more so.

The HHS cancellation of its Moderna contract reflects a deep distrust and misunderstanding of science and public health policy. Led by U.S. Health Secretary Robert F. Kennedy, the Trump Administration has advanced the entirely debunked and disreputable position that vaccines pose a broad and unacceptable danger to humans.

Lacking any training or expertise, Kennedy is openly skeptical of vaccines. He has ordered the Centers for Disease Control and Prevention (CDC) to no longer recommend COVID-19 shots for healthy people during childhood or pregnancy, a major safeguard against the pandemic returning.

And this week took the extraordinary step of firing the expert panel that advises the CDC on immunizations, alleging the action was needed to restore faith in vaccine science. The panel, all distinguished physicians and scientists, are charged with reviewing data on vaccines, debating evidence and voting on who should get shots and when. Insurance companies and government programs like Medicaid are required to cover vaccines recommended by the panel.

Kennedy claimed the panel fueled division and undermined public trust, that it was a creature of politics, noting that two-thirds of the panel had been appointed by the Biden administration. He has since named eight replacements, four of whom have previously spoken out against vaccination in some way, including Robert Malone, MD. who once falsely claimed to be the inventor of mRNA before becoming an inflammatory and misinformed anti-vaccine conspiracy theorist.

Kennedy’s thinking (it can’t rightly be called a rationale since that implies a set of reasons or a basis in logic) is deeply flawed, absolutely political and borders on irresponsible.

“I don’t think there’s any way to put this, other than saying that (the panel’s firing) is an unmitigated public health disaster,” Sean O’Leary, MD, chair of the infectious disease committee for the American Academy of Pediatrics, told The New York Times.

As in the past, Kennedy is lashing out at those who challenge his “facts” and assertions, going so far as to recently suggest that government scientists should be foreclosed from publishing their work in prestigious medical journals like Science, Nature, The Lancet and The New England Journal of Medicine. Kennedy claims these journals have been “corrupted” by the pharmaceutical industry.

That’s ridiculous. To be sure, scientific journals have their shortcomings and make mistakes. But for most journals, especially those considered high impact, the peer review and editorial processes are incredibly rigorous as befits the stringent requirements of science. And as I can attest as an editor, article selection is completely separate from the commercial support of the journal.

And certainly the pharmaceutical industry has its issues. There are plenty of problems to complain about, but vaccine development is not one of them. Moderna and Pfizer, along with other companies, rushed into the breach in the early days of the COVID-19 pandemic, leveraging a new mRNA technology to create effective vaccines with unprecedented speed.

“Never in the history of mankind have such monumental scientific discoveries been made and deployed into practice in such a rapid and effective way,” wrote Michael Saag, MD, associate dean for global health and a professor of medicine at the University of Alabama at Birmingham in a post-pandemic review published in the journal Physiology Review.

It’s my guess that Kennedy missed the article.

Kennedy and the National Institutes of Health have actively and intentionally moved away from promising technologies like mRNA vaccines — without any sound scientific reasons. (See my March 26 letter: Shot Sighted). The Moderna contract cancellation is just the latest, egregious act of ignorance.

Moderna was already in the midst of a Phase I/II clinical trial of its mRNA-based H5N1 vaccine. It had reported early encouraging results: The vaccine generated a quick and robust response, with 97.8 percent of trial participants showing antibody levels believed to be protective three weeks after a second dose. (The vaccine would need to be given in two doses because humans do not have immunity to bird flu viruses.)

Adding injury to injury, the HHS also canceled a $176 million contract with Moderna, only signed last year, to develop mRNA-based vaccines to head off other future viral outbreaks.

Trump Administration officials insist these actions are in the name of public health and safety — and maybe saving some money.

“After a rigorous review, we concluded that continued investment in Moderna’s H5N1 mRNA vaccine was not scientifically or ethically justifiable,” wrote Andrew Nixon, director of White House Communications, in an email.

“This is not simply about efficacy — it’s about safety, integrity and trust,” Nixon continued. “The reality is that mRNA technology remains undertested, and we are not going to spend taxpayer dollars repeating the mistakes of the last administration, which concealed legitimate safety concerns from the public.”

It’s not clear what those safety concerns were. Integrity appears to mean something different in the Trump administration, which appears adamant about making new mistakes all by itself. When the next pandemic invariably arises, we can all expect to pay a heavy and deadly price.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

For Many Researchers, Help Wanted Comes From Distant Locales

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

For decades, the United States has been a beacon for science around the world, both for those who aspire to become scientists and for those seeking to conduct research at the highest levels, with the broadest support and deepest resources.

Now, not so much.

The Trump administration’s ongoing assault on science, from funding cuts and mass firings to reversing and eliminating programs and projects based on political ideologies, has fundamentally altered the equation.

The U.S. is still the world’s science superpower, but it is losing ground. Other countries are investing more. China is close behind in terms of funding research and development. By some estimates, it will draw level in the next few years. By other measures, it is already ahead: producing more science and engineering PhDs and filing more international patent applications.

Instead of U.S. science attracting and keeping the best minds, as has been the case for many decades, many scientists are deciding their prospects and futures may be brighter elsewhere. Equally, if not more concerning, other countries have begun to actively recruit American researchers at risk to pick up their labs and move. Researchers who came to this country to work are finding it hard to stay.

“Nobody could imagine a few years ago that one of the great democracies of the world would eliminate research programs on the pretext that the word ‘diversity’ appeared in its program,” President Emmanuel Macron of France said during a recent speech announcing a major new effort to attract U.S.-based researchers to Europe.

At the same conference, Ursula von der Leyen, president of the European Commission, announced an investment of 500 million euros ($566 million), to “make Europe a magnet for researchers” over the next two years.

That new funding is in addition to a $105 billion international research program called Horizon Europe that supports many of the scientific efforts that the Trump Administration seems intent on quashing, such as mRNA vaccines.

Of course, a shrinking scientific enterprise in the U.S. hurts Europe too. It hurts everyone. Modern science requires deep and continuing collaboration. But science leaders and institutions outside the U.S. also see opportunity. If the U.S. doesn’t want to support the work of leading scientists, said Macron, others will, promising government support to help lure international researchers.

A recent poll of more than 1,600 U.S. scientists by the journal Nature found that three-quarters of them said they were looking for jobs in Europe and Canada. The trend was particularly pronounced among early-career researchers. Of the 690 postgraduate researchers who responded, 548 were considering leaving the U.S.; 255 of 340 PhD students said the same.

That’s not surprising. The Trump administration has terminated hundreds of research grants and dramatically reduced or limited what it deems worthy of funding, often based on non-scientific reasons or no apparent reasons at all.

“This is my home — I really love my country,” a graduate student at a top U.S. university wrote in responding to the Nature survey. “But a lot of my mentors have been telling me to get out, right now.”

She doesn’t have much choice. Her research support and stipend ended when the Trump administration shut down funding to the agency that supported her work. Her adviser found emergency funds to support her short term, but to continue her career, the graduate student is applying for research positions in Europe, Australia and Mexico.

Her story is not uncommon, but at least she’s already embarked upon her science career. Universities across the country are cutting education programs, reducing graduate student admissions and decreasing support.

Not all of the adverse effects will be immediately felt. These students represent the next generation of scientists. Like their predecessors, they are motivated to find answers to the great scientific questions of our time, to improve our understanding of the world and our lives.

And they will. They just may not do it in the United States.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

We’re Not All White Men

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

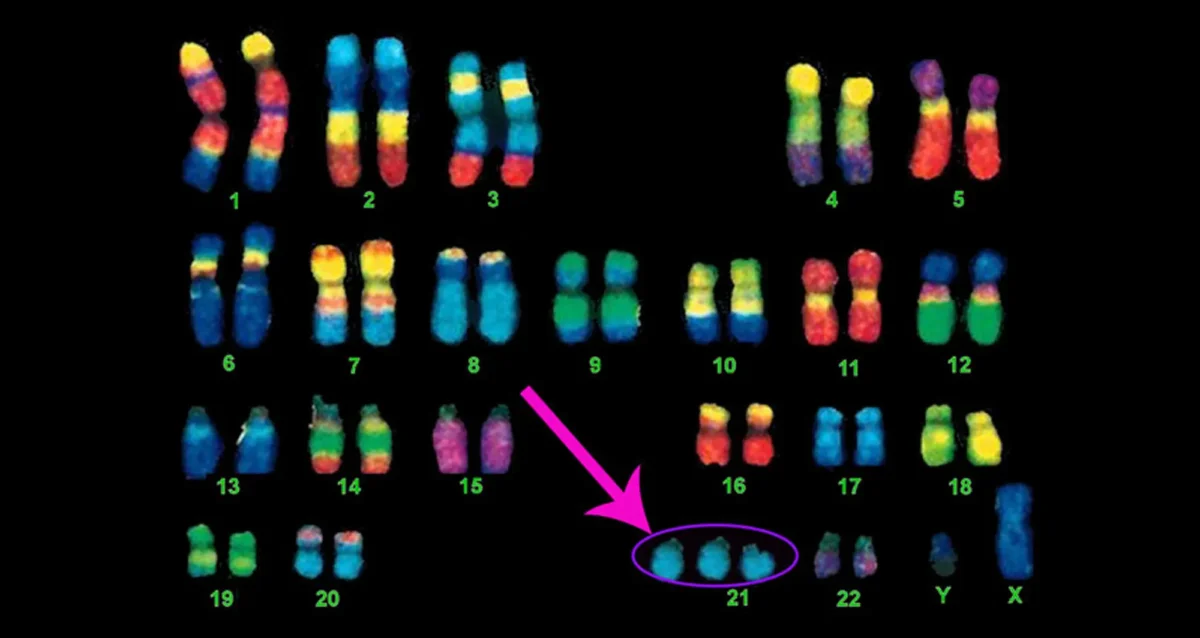

The history of biomedical research has largely been the history of white men, who have disproportionately been both the drivers of science and the subject of their own studies. White males were presumed to be the human norm; everyone else was an extrapolation.

Of course, such thinking ignored or was ignorant of the fact that many diseases and treatments are either unique or more common to women and minorities. Also, many diseases have different manifestations or responses to therapy in women and minorities than in white men. This lack of diversity in thought and practice was born of many motivations, from bad science to outright racism to misguided notions of chivalry.

It would be several years before public and private efforts would start to rectify the patriarchal practice, perhaps most dramatically with the creation of the Women’s Health Initiative (WHI) in 1991, which began with three clinical studies funded by the National Institutes of Health at the direction of its first female director Bernadine Healy, MD. These trials would investigate cardiovascular disease, cancer and osteoporosis in more than 160,000 postmenopausal women ages 50-79.

The WHI trials were profoundly influential, leading to discoveries like breast cancer rates could be decreased by reduced use of hormone replacement therapy and that hormone replacement therapy did not prevent heart disease. The trials helped save roughly $35 billion in direct medical costs over 15 years, and the scope of the WHI was expanded to include research involving younger women, whose health status and issues are different.

In 1993, the FDA finally reversed its 1977 guidance and Congress passed a law requiring women be included in NIH-sponsored clinical trials. In 2001, the Institute of Medicine issued a report confirming that males and females differ in both physiological and chemical ways.

“Every cell has a sex,” the report’s authors stated. Scientists need to take these differences into account.

As many, many studies have since shown, gender does play a role in numerous diseases and disease-related factors, such the incidence and severity of heart disease, obesity, rheumatoid arthritis, multiple sclerosis and other illnesses. Women’s menstrual cycles can cause them to respond differently to drug treatments.

It’s obvious why only men experience prostate cancer and only women get ovarian cancer. It’s not obvious why women are more likely than men to recover language ability after a stroke or why women are at greater risk than men for autoimmune diseases like lupus. The explanation for why women tend to live longer than men, regardless of where they live, how much many they make and many other factors, is woefully incomplete.

So it made absolutely no sense late last month when the Trump Administration indicated that it would be gutting the Women’s Health Initiative, canceling funding to continue monitoring the lives of the original WHI cohort, now in their 80s and 90s, and ongoing research and trials for diseases like cancer and dementia that have enrolled 42,000 women.

The resulting outrage compelled the Trump Administration to promise WHI funding would be fully restored, though WHI investigators have reported that, as of April 25, they had not received official confirmation of restoration from the NIH.

Hopefully, the WHI can return to its work, fully funded. Other groups long ignored or underrepresented in biomedical research will not be so fortunate. Trump’s assault on science — and particular demographic groups — continues unabated. The NIH has terminated more than 800 grants. Nearly one-third of the terminations have been for research that mentioned HIV/AIDS, which disproportionately affects sexual and gender minorities (LGBT+) and one-quarter for studies related to the health of transgender people.

On his first day in office, President Trump issued an executive order declaring there were only two genders: male and female. Trump, who has a bachelor’s degree in economics, said he was restoring “biological truth.”

The NIH and other funding agencies have been ordered to comb through thousands of active research projects for key words like antiracist, historically, inequities, male dominated and underserved. These projects are at risk. At the Centers for Disease Control, website content containing terms like gender, transgender, pregnant person, pregnant people, LGBT, transsexual, nonbinary, assigned male at birth, biologically male, biologically female, he/she/they/them has been edited or removed.

No one yet knows the full implications and consequences of these actions, least of all the people enacting them. But they will be bad. There is no upside to slashing science and slowing, stopping, or reversing decades of progress.

The current crisis in research hurts everyone. The National Science Foundation, which funds basic science research across the spectrum, has been ordered to “stop awarding all funding actions until further notice” and to reject incoming research proposals deemed not “in alignment” with agency priorities. The NIH has scaled back its awards of new health science grants by at least $2.8 billion since the beginning of the year — a roughly 28 percent contraction with more funding cuts looming.

The pain and peril are everywhere, but they hurt first and hardest among those members of society who were just beginning to be embraced (imperfectly) by the rest of us. The history of biomedical research is checkered with racism, bias and myopia; its immediate future appears to be repeating the past.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Alternative Thinking: Using Science to Fix Science

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

In a recent letter to Michael Kratsios, President Trump implored his 38-year-old director of the White House Office of Science and Technology Policy to “blaze a trail to the next frontiers of science.”

Trump spoke of creating new, innovative models for funding and sharing scientific research, of building “an ecosystem that attracts top talent, celebrates merit, protects our intellectual edge and enables scientists to focus on meaningful work rather than administrative box checking.”

He said America’s science and technology enterprise can be revitalized by “pursuing truth, reducing administrative burdens and empowering researchers to achieve groundbreaking discoveries.”

Trump got the sentiment right and the facts wrong.

Science is not about absolute truths, not in any ultimate or philosophical sense. It is an ongoing process of exploration, discovery and refinement to better understand the natural world. Scientific knowledge changes with new data, understanding and time. It is based on empirical evidence — information gathered directly or indirectly through observation or experimentation, the cornerstone of the scientific method.

Here are some empirical facts:

White House Science Advisor Michael Kratsios with President Trump.

The Trump administration has issued a series of executive orders and policies that adversely affect America’s science and technology enterprise, beginning with the National Institutes of Health’s proposed 15 percent cap on all indirect cost (IDC) reimbursements.

IDC helps cover some of the true costs of doing science. An across-the-board 15 percent cut represents a massive reduction in federal support of science. Rather than “accelerate research and development,” per Trump’s call to action, the cap will have the opposite effect. Less investment means less achievement. Slashing IDC slashes research.

The president says the United States “must maintain technological supremacy” in the world, but under his administration, hundreds of research grants have been terminated for non-scientific reasons, creating chaos and uncertainty, especially among young or future scientists who are now second-guessing their career choices.

Kratsios is charged with finding new ways science can “fuel economic growth and better the lives of all Americans.” But again, actions undermine words. Research universities and non-profit research institutions like Sanford Burnham Prebys confront difficult choices necessary to survive, such as hiring freezes, layoffs, closing labs, ending programs or shuttering facilities.

In 2023, according to Biocom, nearly 76,000 San Diegans worked directly in science, with 178,000 others in related jobs. Science generated more than $56 billion in total economic output. Less science means fewer jobs, not exactly empowering economic growth and better lives.

There is broad consensus in the scientific community that improvements can be made to strengthen the historic partnership between the federal government and U.S. research institutions. It’s not a new point of view. Kelvin Droegemeier, Trump’s science adviser during his first term, said as much, advocating for greater transparency and a reduction in the regulatory burden.

Researchers agree. Greater transparency and the elimination of unnecessary regulations are good for science. Groups like the Association of Independent Research Institutes and the Association of American Medical Colleges are working to propose new ways to think about and fund science, to create a predictable, sustainable funding environment that reflects the scale and complexities of today’s research, especially in the life sciences.

This effort is on the fast track, with the goal of releasing a new framework by the end of summer. The Trump administration apparently can’t wait for a comprehensive and thoughtful plan prepared by people with genuine expertise in the biomedical research enterprise.

Instead, his administration is plowing ahead with their ill-advised and draconian cuts to science. Last week, the Department of Energy followed NIH in proposing to slash IDC rates to 15 percent. This week, we learned that the administration plans to cut spending at the Department of Health & Human Services (HHS) by nearly a third and at the NIH by 40 percent.

In its own self-description, “the mission of the U.S. Department of Health and Human Services is to enhance the health and well-being of all Americans, by providing for effective health and human services and by fostering sound, sustained advances in the sciences underlying medicine, public health, and social services.”

It’s Orwellian gaslighting: Cut health and science funding while insisting less means more. The U.S. Constitution grants Congress exclusive power of the purse. Legislators can intervene to preserve and advance the scientific enterprise and the health of the country. Will they rise to the occasion?

Change is inevitable, but it should be shaped by careful and informed consideration, not by mindless cuts couched in magniloquent but malevolent phraseology. President Trump says we should all seek to “cement America’s global technological leadership and usher in the Golden Age of American Innovation.”

Absolutely, but doing so requires leadership and action based on empirical evidence.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Terminated Grants May Mark the Beginning of Really Bad News to Come

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

From the proposed across-the-board cap on indirect costs to freezing study sections to backing away from promising new technologies like mRNA vaccines, recent actions by the National Institutes of Health (NIH) threaten the future of U.S. science.

The number of new grants handed out by the National Science Foundation has fallen by 50 percent. Last year, the NIH awarded approximately $2.5 billion in grants in the first six weeks of 2024. This year, it was $1.4 billion for the same period—a sum smaller than any of the previous six years.

But the past and present are also at risk, and specifically the forced abandonment of research already conducted or underway that has significantly advanced our understanding of many diseases and public health threats.

At the direction of the current administration and reportedly often without expert NIH staff input or review, hundreds of previously approved research grants have been terminated. These are projects that had already been vetted by experts and deemed worthy of support and further investigation.

The research goals of these terminated grants had not yet been fully realized. Data was still being gathered; final outcomes were yet to be determined. The grants were cancelled, according to the administration, because the funding promised but not yet provided could be reclaimed as “savings.”

It’s clear these grants were targeted as part of a larger political agenda. On-going research to develop better vaccines (not just COVID-19, but vaccines for conditions like shingles and other common afflictions), better understanding of vaccine hesitancy, alleviation of anxiety and depression among transgender and gender-minority teens, improved health care for under-represented groups and HIV prevention were all gutted.

These grant terminations, utterly lacking in scientific rationale, create real and immediate consequences.

They create waste and lost time. There is no value to research half-completed, before it can gather statistically relevant and useful data necessary to arrive at valuable conclusions, insights and actions.

The clawing back of promised funding means laboratories and institutions are suddenly unable to afford to press ahead. Without vital funding, faculty and staff face lay-offs and perhaps the shuttering of entire labs. The actions chill the ambitions of young scientists we need for future innovations that will drive our economy in the coming decades. An entire generation of scientists is in danger.

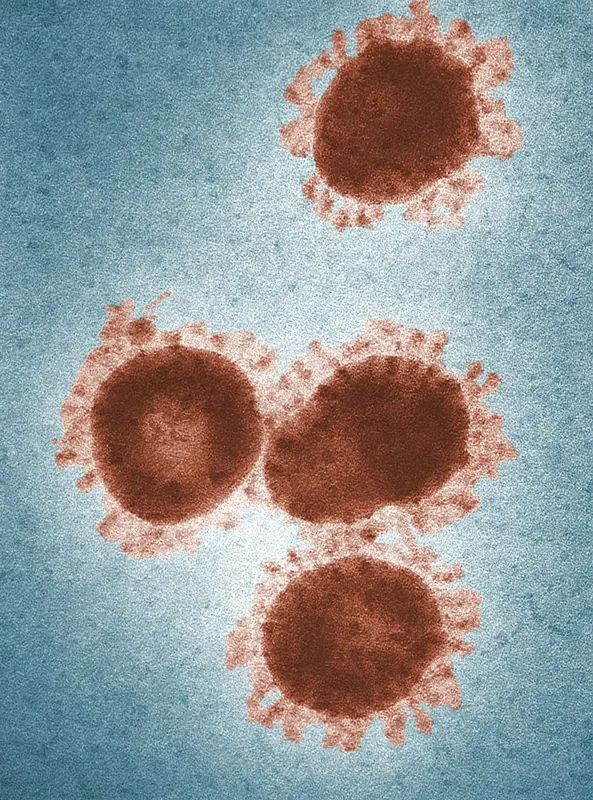

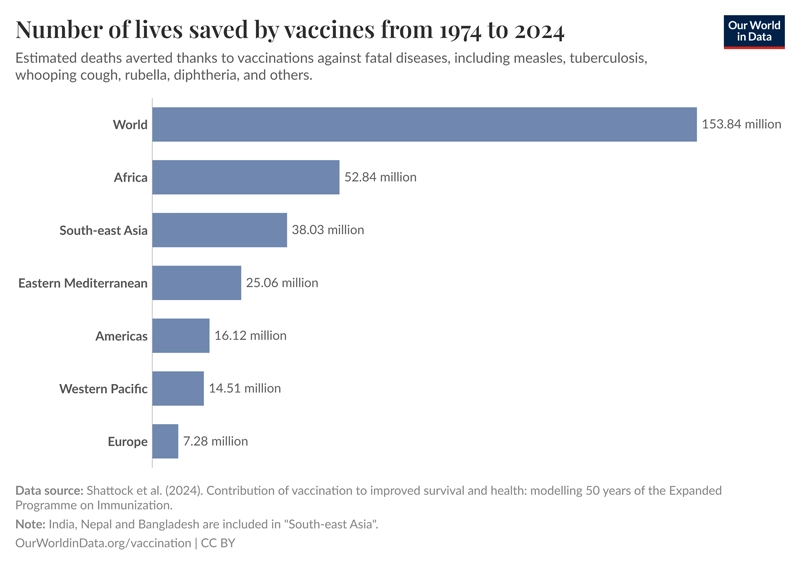

Most ominously, the grant terminations put us all at greater risk. For example, there will be future pandemics. They are inevitable. Preparation is critical. Because of years of research into mRNA vaccines, safe and effective COVID-19 vaccines were created in record time and saved millions of lives.

Likewise with HIV. Thanks to recent decades of HIV research, AIDS is now more of a chronic condition than a death sentence. But it is beyond foolish to think that the ever-changing viruses that cause COVID-19, AIDS and other global scourges will stop threatening public health just because we’ve stopped conducting research to fight back.

The administration asserts that spending money on research for COVID-19 and similar infectious diseases is a waste. The pandemic is over, says President Trump, who has made that declaration many times going back to its earliest days.

It is true that the COVID-19 pandemic was officially declared ended by the World Health Organization on May 11, 2023 because it no longer met the defining criteria of “pandemic.”

But the virus still killed 2,130 people in the U.S. last month and thousands more worldwide.

The SARS-CoV-2 coronavirus still circulates, still mutates and may again emerge as a worldwide menace.

Or something like it. We hear sirens warning of the next pandemic in the nightly news: Ebola, mPox and unknown infections identified in Africa. Avian flu and resurgent measles spreading in our own country. Viruses recognize no borders or limits.

Current grant terminations and those to come that target other efforts for non-scientific reasons will only make us weaker, which is always a welcome sign for opportunistic pathogens.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Shot Sighted: NIH Backs Away from mRNA Vaccine Technology

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

In a 2020 speech at the height of the pandemic, President Trump celebrated his administration’s Operation Warp Speed for its rapid development and deployment of COVID-19 vaccines. He called it “an incredible success.” And rightly so.

The two most widely deployed COVID vaccines came from the biopharmaceutical companies Moderna and Pfizer. They were administered billions of times worldwide during and after the pandemic. It is estimated these vaccines (with a handful of others) prevented at least 14.4 million deaths worldwide, including more than 3 million in the United States alone.

Three years later, the two scientists whose groundbreaking work led to the COVID-19 vaccines, would win the 2023 Nobel Prize in Physiology or Medicine.

What made the Moderna and Pfizer vaccines particularly notable was how quickly they were created—just 10 months from when the virus got its official name. The speed of development was due to the technology used, which is based on messenger RNA (mRNA), a single-strand molecule that instructs cells how to build specific proteins.

In the case of COVID-19 vaccines, the mRNA contains the blueprint to create the characteristic protein spikes on the virus’ surface which then primes the body’s immune system to respond quickly and effectively when exposed to the actual virus.

Traditional vaccines use bits of weakened, inactive or synthetic virus, which requires growing massive amounts of cultured live virus or cells, an extremely time-consuming and costly endeavor. In contrast, once a vaccine target mRNA is designed and synthesized, it can be quickly mass-produced.

Now, in its latest inexplicable and counter-productive order, the National Institutes of Health is reportedly urging scientists to remove all references to mRNA vaccine technology from their grant applications. It has already terminated at least one grant. It has offered no explanation.

The move, say observers, may signal the agency’s abandonment of mRNA technology, which has huge therapeutic potential, not just for treating or preventing infectious diseases, but also immunological and cardiovascular conditions, tissue damage and cancer. Some cancer mRNA vaccines are already in clinical trials.

The NIH’s apparent opposition to mRNA research is not surprising. It is a continuation of a series of actions based on misinformation, lack of knowledge or, in this case, a particular antipathy for vaccines, which conspiracy theorists claim without any scientific evidence are dangerous and health threatening.

Robert F. Kennedy, Jr., the Health and Human Services Secretary in the second Trump administration, has a long history of making false and misleading claims about vaccines and COVID-19. In 2021, he unsuccessfully petitioned government regulators to rescind approval of mRNA COVID-19 vaccines, falsely declaring them to be “the deadliest vaccine ever made,” based on unverified claims of side effects.

Kennedy has long opposed vaccines of all sorts. He has wrongly alleged that the childhood vaccine for measles, mumps and rubella (MMR) is linked to autism and other neurological disorders. That specious allegation was rebutted by hard science long ago.

Under Kennedy’s watch, the NIH has terminated at least 33 research grants for projects to better understand why some people are hesitant to receive vaccines or to evaluate strategies that encourage key vaccinations.

“It is the policy of NIH not to prioritize research activities that focuses [sic] gaining scientific knowledge on why individuals are hesitant to be vaccinated and/or explore ways to improve vaccine interest and commitment,” the termination letters said.

As a result, less critical science is being done, less knowledge is being learned and more health catastrophes are the offing.

Measles is an example. It is a highly contagious disease that was officially declared eliminated in the U.S., thanks in large part to the MMR vaccine, which was introduced in 1971. With larger numbers of Americans deciding to forego MMR vaccinations of their children, herd immunity has declined and the disease has returned.

An outbreak in Texas is growing with no end in sight. It has already killed an unvaccinated 6-year-old child in Gaines County, Texas, the center of the outbreak. It is also the suspected cause of death of an unvaccinated adult in New Mexico.

A measles outbreak, to quote an infectious disease epidemiologist, is “like a forest fire throwing out sparks.” The outbreak will burn past state lines.

The Centers for Disease Control is keeping tabs, but federal health authorities have been mostly silent on the measles outbreak. Kennedy has promoted alternative treatments, such as steroids, antibiotics and cod liver oil.

None are known to be effective against measles, but cod liver oil has been proven effective as an antidepressant. That might be needed.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Science Starts Here: Research Institutions and Academia

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

The biotechnology market in the United States is gargantuan, exceeding $553 billion in 2023 and projected to grow to almost $1.8 trillion by 2033. The current U.S. pharmaceutical market is even bigger at $639 billion last year, projected to reach more than $1 trillion by 2030.

Both are global leaders in size and output. In a study published a few years ago, researchers found that of 252 new drugs approved by the U.S. Food and Drug Administration (FDA) between 1998-2007, 118 originated in the U.S. Japan, the United Kingdom and Germany were next, but all in the low 20s.

More than half of new drugs are first launched in the United States each year. The FDA approved 50 new therapeutic compounds in 2024. It may not sound like a lot, but no other country comes close.

It takes a lot of time and money to conceive, develop and successfully get a new drug to market. The estimated mean cost from start to finish is $172 million. Add in capital costs and the inevitable failures along the way (90 percent of new drugs fail clinical trials) and that estimate rises to nearly $880 million per new drug. The average time required to develop a drug and get FDA approval, if it happens at all, is 10-15 years.

These are daunting numbers, and so it’s no surprise that the biotechnology and pharmaceutical industries are always keen to minimize financial exposure and risk. They are, after all, for-profit enterprises. They pursue every possible angle to ensure their drug investments yield maximal results.

They can do this in large part because of a long and lucrative arrangement with academia and independent, non-profit biomedical research institutes like Sanford Burnham Prebys, who have historically done the initial heavy lifting, from basic discovery through the early stages of clinical trials.

Universities and research institutes typically pay out of their own pockets to fund research in its earliest stages when ideas are too unproven to secure government funding. Big Biotech and Big Pharma prefer to take promising drugs over the finish line, but not necessarily get the process started.

Original thinking and innovation most often happen where the pursuit of new knowledge is the primary mission. That’s in the DNA of universities and independent research institutes. Universities and independent research institutes exist to ask and answer the hard, basic, necessary questions of science that may or may not lead to new drugs, treatments and improved human health.

Academic and non-profit scientists can do this kind of work because the institutions where they work are structured to support their research, and those institutions are supported by the National Institutes of Health (NIH) and its enduring, highly successful partnership with universities and research institutions to advance American science.

“We cannot be a strong nation unless we are a healthy nation. And so, we must recruit not only men and materials, but also knowledge and science in the service of national strength,” said President Franklin D. Roosevelt in 1940 at the dedication of the first buildings that would headquarter the newly created NIH.

That vision—and the promise of future achievement—is now severely threatened by the NIH’s announced efforts to cap indirect costs (IDC) and other related acts of obstruction (see earlier letters).

In recent years, there has been a push to create new and more collaborations between biotech/pharma and academia/non-profit research. These are welcome and vital, given the extraordinary costs and complexities of biomedical research.

For example, the Conrad Prebys Center for Chemical Genomics at Sanford Burnham Prebys is the largest nonprofit drug discovery center in the United States. Its researchers work with biotech, pharma and other institutions to translate promising ideas into new drugs by assessing and testing thousands of potential therapeutic compounds each year to determine which might meet the strict criteria for clinical trials.

But this kind of partnership comprises only a fraction of total research. It cannot compensate for the diminishing and dismemberment of the current NIH-supported system, which contributed to published research associated with every one of 210 new drugs approved by the FDA from 2010 to 2016.

Certainly, the system can be improved, but it has worked remarkably well for more than 75 years.

Biotech and Big Pharma are the beneficiaries of basic science conducted in academia and at independent research institutions. They often have limited ability to do basic research, or the desire. The return on investment (ROI) is just too low: In 2023, the projected ROI in pharmaceutical research and development spending was 4.1 percent, which represents an upswing. In 2022, it was 1.2 percent.

Advocates for the IDC cap and other related measures do not recognize this reality or the real costs of doing science. Implausibly and without evidence, they propose cuts, reversals and retrenched thinking at a time when public health threats are urgent (think measles) and experts say U.S. research is in decline.

IDC caps and similar misguided notions will only weaken science, our health and the nation.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Science Goes “Dry,” Funding Cannot

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

The current and continuing crisis in biomedical research funding, spawned by recent actions by the federal government, is impairing how laboratories function and, consequentially, the promise of new drugs and treatments.

For many, scenes of scientists laboring in semi-isolation in the lab, surrounded by the tools of their trade, from microscopes to Bunsen burners, are stereotypical. But times and technologies have changed.

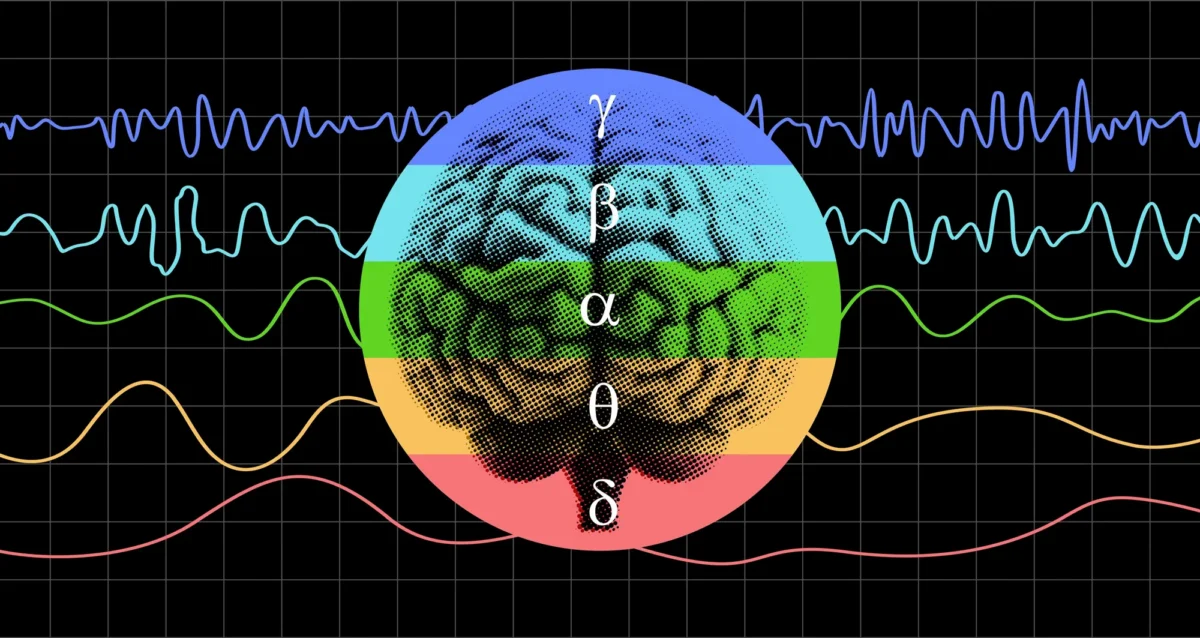

There are still plenty of old-school “wet labs” where scientists work with tissue cultures, organic chemicals and liquid substances. Wet labs remain the backbone of life sciences. But more and more, there are “dry labs” in which experiments and studies are performed using computational or mathematical applications. Life in silico.

Both types of laboratory house laboratory information management systems, known as LIMS, that employ advanced software programs capable of organizing, managing, validating and storing enormous amounts of data, then feed it back into a world increasingly awash in information.

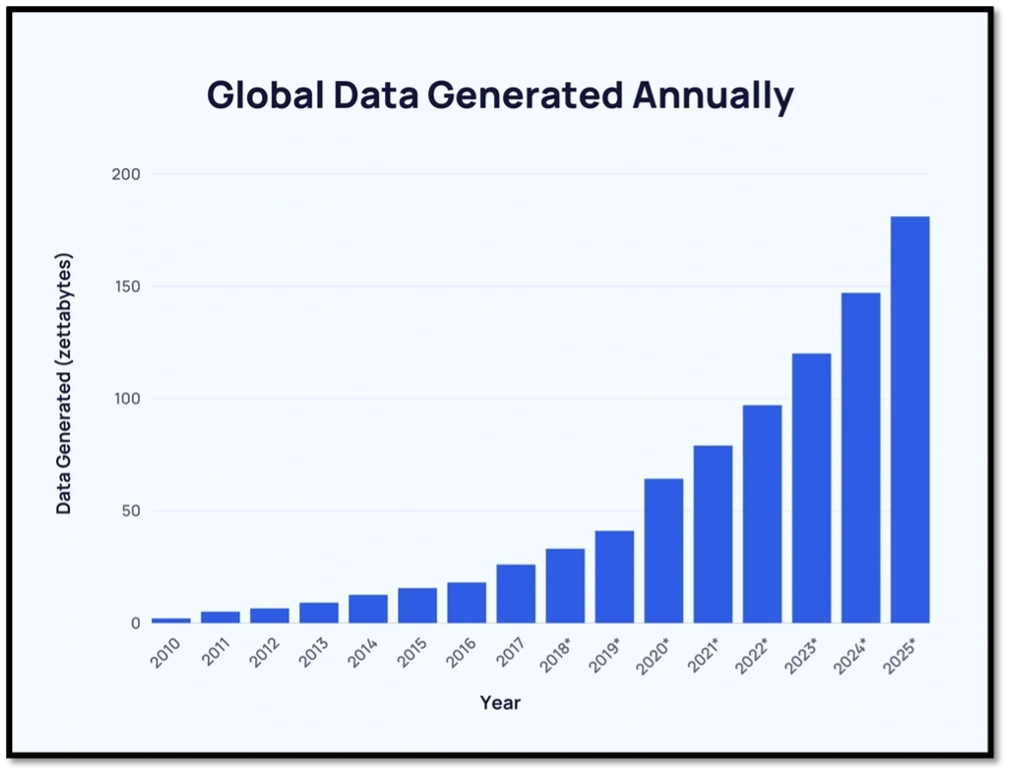

In 2024, roughly 402 million terabytes of data were created, captured, copied or consumed each day, adding up to 149 zettabytes of data per year. A terabyte is 1 trillion bytes or units of information—the equivalent of 1,000 copies of the Encyclopedia Britannica. A zettabyte is one sextillion bytes or a 10 followed by 21 zeros. It is enough data to fill more than 25 billion 32GB Apple iPads, enough iPads to build a Great iPad Wall of China.

We generate more information in a couple of days than has been captured from the dawn of human civilization to the 21st century. By 2028, it’s estimated the annual volume of information will be almost 400 zettabytes.

Much of this data explosion comes from science.

One example: In July 2021, the technology company DeepMind announced it had used artificial intelligence (AI) to predict the shape of almost every protein in the human body, as well as hundreds of thousands of proteins in other organisms. Although the accuracy varied, they were able to share some 350,000 totally new predicted protein structures.

Such breadth and depth of new knowledge advances biomedical research, from better understanding protein functions in cells to defining diseases more precisely and thus potential remedies.

Indeed, researchers at Sanford Burnham Prebys have leveraged the power of machine learning to systematically predict patient responses to cancer drugs at single-cell resolution.

Source: Semrush/Exploding Topics

These capabilities are not inexpensive. A sophisticated LIMS with necessary computing power, specialized software and sufficient data storage can cost tens to hundreds of thousands of dollars per year. Like much else in life, prices tend only to rise, including more prosaic examples of indirect costs, such as utilities and insurance. They are all essential to functional, effective science.

Modern labs have embraced this transformative shift in the pursuit of knowledge. A scientist using tools like AI, robotics and next generation DNA sequencing can gather more data in a single experiment or in a weekend of work than they could in a career just a few years ago.

Effective research today demands collaboration and coordination across laboratories and disciplines. It involves diverse types of experts and expertise who work across the hall and around the world. They must be nimble and adaptable because what constitutes “current thinking” may rapidly become incomplete or outdated.

The pronouncements by the National Institutes of Health to cap indirect costs and related actions like stopping study sections necessary to review and fund new research projects slow, and perhaps reverse, progress toward new discoveries and cures in biomedical research. Ignorance is this.

Technologies in modern labs are not simply an “indirect cost” of research. They are essential to actually conducting research, from the costs of utilities, required regulatory compliance and safety measures to administrative support. Indirect costs are not a tax on science. They do not detract or subtract from research. They support the institution’s ability to support the science.

“Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less,” two-time Nobel laureate Marie Curie once said.

The current and continuing crisis compels scientists to do less. Without remedy, the consequences will be fearful.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Frozen Sections: A Study in Science Stopped Cold

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

Since the end of World War II, when the federal government first determined that it would become the primary driver of American science, the National Institutes of Health, the largest funder of biomedical research in the world, has relied on a two-pronged process to fund biomedical research:

First, “study sections” would assess the quality and viability of proposed research grants.

Second, there would be a final review by an NIH advisory council and funding would be approved for worthy proposals.

After inauguration, the Trump administration initially froze all federal funding, including for biomedical research.

When a court issued a restraining order requiring them to backtrack, the administration decided to take an end-run around the court order. The NIH stopped the standard required practice of posting public meeting notifications in the Federal Register, the official daily publication of the U.S. government. As a result, dozens of long-scheduled study sections and advisory councils were canceled, effectively suspending the review process and stopping all new grant funding.

No notice, no meetings.

No meetings, no grants.

No grants, no science.

Top: the first NIH study section in 1946

and a study section today.

Study sections are gatherings of independent scientists deemed among the best and most experienced in their field(s). They possess the knowledge and expertise to effectively judge the merits of a grant application: Is the research topic and goal worthy of investigation?

Does the applying researcher possess the credentials and abilities to effectively conduct the science proposed? Is there compelling data to support the proposal? Will the money be well-spent?

Study sections are grueling. They are not for the weak of heart or data. Proposals are frequently rejected, sent back with requests for more information, more research or greater refinement. Proposals that make it to the second and final stage have been scored on a 9-point scale (from 1 for exceptional to 9 for poor) for both overall impact and individual review criteria. These proposals compete against other scored proposals for actual funding.

Only the best of the best prevail, and not very many of them. Each year, the National Institutes of Health receives more than 50,000 grant proposals, a number that is steadily increasing. Less than one in five of these proposals is funded, a number that is steadily decreasing.

Study sections are the engines of science. They move research from idea to action. If they aren’t working, neither is science.

Study sections aren’t the only part of the research machine that has stalled. Required notices of meetings by advisory councils have also largely stopped. The meetings provide additional review and make final funding recommendations.

Each of the 27 NIH institutes has its own advisory council and they typically meet in January, May and September. None of these councils has met since the communications freeze was ordered in late-January, effectively cutting off the means to award new grants.

The result: New science has effectively stopped. Researchers at institutions, large and small, who have labored for months, perhaps years, to develop new proposals cannot obtain required feedback, let alone funding. The study section halt has already held up an estimated $1.5 billion in new funding for everything from Alzheimer’s disease and cancer to allergies, addiction and antibiotic-resistant bacteria.

The harm is real. Scientists who cannot get their research reviewed and funded in timely fashion face the prospect of cutting back their work, including laying off staff and support personnel. Some universities and medical schools have already enacted hiring freezes or paused graduate admissions.

The veteran scientists who participate as reviewers in study sections are usually unpaid. They do it as a service to each other and to keep science moving forward. With study sections suspended, nothing is moving, including progress toward improved health.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Building a Stronger Foundation for Science

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

The National Institutes of Health’s (NIH) proposed cap on Facilities and Administrative (F&A) costs, now paused pending the outcome of several lawsuits, remains ill-conceived and disregards the long, productive relationship between the federal government and the scientific community, one that has made the U.S. research enterprise unparalleled in the world.

In response to my first letter, I received several questions about the NIH’s rationale for their decision to cap F&A at 15 percent and, in particular, the role of private foundations in supporting research.

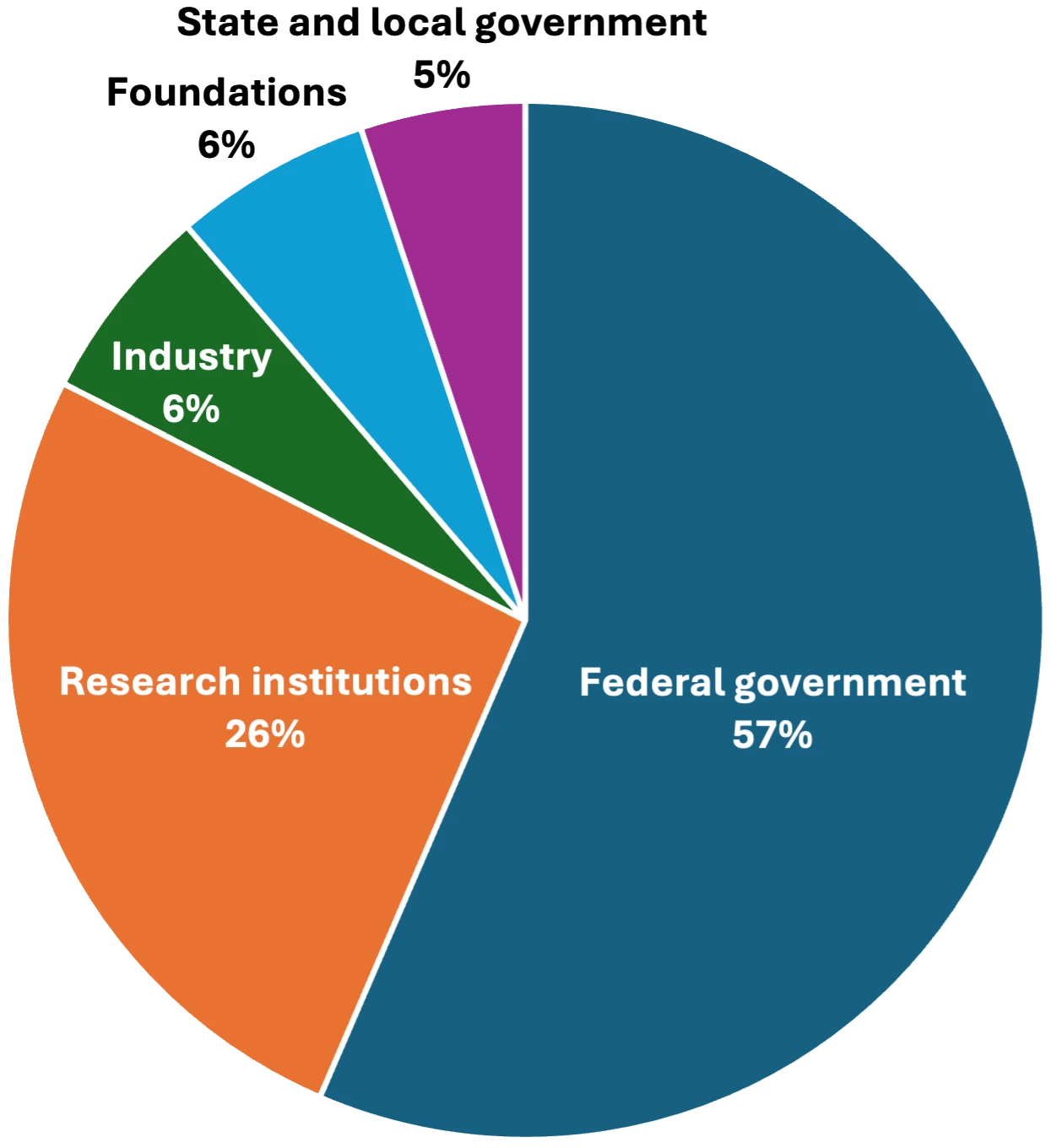

The NIH explained its dramatic reduction by noting that foundations typically pay even lower F&A rates than the government. The rationale is misleading.

Private foundations play an indisputably valuable role in the discovery of new drugs and therapies. Their support is often the boost that jumpstarts experiments, closes a critical funding gap, drives a fundamental systems change or simply accelerates progress toward a targeted goal, whether that’s a promising new drug to treat Alzheimer’s disease or a cure for a rare congenital condition in children.

Every year, foundations and other sources of philanthropy give billions of dollars to specific purposes and causes.

But comparisons between the type of research funded by the federal government and research funded by foundations is apples and oranges. If science is fundable by foundations, it is often precisely because it is not fundable by the NIH.

This is by design. The NIH historically emphasizes support of traditional lab-based biomedical research. Foundations, on the other hand, often specifically target research that NIH does not support because they want to fill gaps in the scientific enterprise to get the most impact from their investments.

They may be involved in global issues like reducing hunger or eliminating diseases endemic in distant parts of the world. They may focus on a specific health issue, such as a rare childhood disease. Or they may focus on early-stage investigators, translational research or high-risk, high-reward research that the NIH doesn’t fund.

If scientists want to pursue these projects, foundations are frequently the only source of support. Research institutions often have no choice but to pursue foundation money to support these promising areas of research.

And so they do, even with foundations’ lower F&A rates. But the practice does not represent the true cost of science and research institutions must use other sources of money, often philanthropic, to cover the shortfall.

This is possible only because foundation funding comprises a small percentage of support at research institutions. Foundation funding accounts for roughly 6 percent of biomedical research in the United States, according to a Council on Governmental Relations study. If foundations made up a larger portion of the funding pie, then research institutions would not be able to fill the shortfall or accept their money.

The NIH is the largest funder of biomedical research in the world. Last year, it devoted nearly 83 percent of its $48 billion budget to medical research conducted at universities and research institutions like Sanford Burnham Prebys. That translated to more than $35 billion spent supporting almost 50,000 research grants to 300,000 researchers at more than 2,500 universities, medical schools and research institutions in the U.S. Roughly $9 billion was allocated for F&A expenses.

If neither the NIH nor foundations adequately cover F&A expenses, institutions like Sanford Burnham Prebys must make up the difference themselves, reduce their scientific activity or even abandon aspects of it altogether. The result: Biomedical research slows down and cures are delayed.

A robust analysis of the role of foundations in the research enterprise would have led the NIH to issue a much different notice: One that called for non-federal funders to begin supporting the true cost of research. Instead, they misrepresented how foundations fund research to falsely rationalize their proposed budget cuts to lifesaving biomedical research.

This is a moment of crisis. The NIH F&A cap represents an unwarranted threat to the health of biomedical research—and by extension, our own health. It is an existential threat to some institutions. We must respond together to achieve our goal: Better, longer lives for all.

The scientific community stands ready to help, to explain why these costs are necessary, and to offer guidance and advocacy.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

The Unacceptable Cost of Capping Indirect Costs

A letter from David A. Brenner, MD, President and CEO of Sanford Burnham Prebys

Recently, the National Institutes of Health (NIH) announced it would immediately cut the indirect cost rate to an across-the-board 15% cap on all biomedical research funding, current and future. The action is abrupt, arbitrary and ill-conceived—and it represents a profound and unacceptable threat to universities, hospitals and research institutions like Sanford Burnham Prebys.

We stand adamantly opposed to the NIH policy change and, in alliance with scientific institutions and organizations on the Mesa and across the country, we are working to have the policy change revoked, and the future of good science assured.

There is always room for reasoned discussion, reforms and remedies to all issues, but the NIH’s decision creates a real and perhaps existential threat to the foundation, quality and prestige of U.S. science, now and in the years to come.

Since 1947, the federal government and thousands of research institutes, universities and hospitals across the country have benefitted from a strong and unshakeable partnership dedicated to advancing biomedical discovery in the search for and the development of new drugs, treatments and therapies for the common good.

This powerful collaboration has made U.S. science and medicine a global exemplar, from basic research that lays the foundations of knowledge and inspiration to translational and transformational science that results in the development and introduction of new and better treatments for everything from cancer to Alzheimer’s to infectious diseases to the ubiquitous metabolic disorders of obesity, diabetes and fatty liver disease.

Biomedical research is our bulwark against and the remedy for current and future threats to our health, both as individuals and as a society.

There are only two categories of funding in biomedical research. The first is “direct costs,” which are those easily ascribed to a specific research project, such as chemicals necessary for experiments and the salaries of those doing them.

Indirect costs cover the ways, means and tools necessary for scientists to do their work. They are the critical and unavoidable expenses related to the infrastructure of biomedical research, such as keeping the lights and heat on in laboratories, administering payrolls, purchasing specialized instruments, maintaining data cybersecurity and ensuring the safety of human participants.

A 15% cap on indirect costs support recklessly slashes biomedical research, negatively affecting almost every research institute, university and hospital, along with the biotechnology and pharmaceutical industries that rely upon our original and innovative efforts.

The ripple effect is immediate and long-term. The cap would measurably slow the pace of discovery and progress as scientists revised their goals, retrenched efforts, reduced investigations and, in some cases, just stopped doing or pursuing promising avenues of inquiry.

The cap poses particular impact in a place like San Diego, which has long been a hub for biomedical research. The region is home to nearly 2,000 leading universities, research institutes, hospitals, biotechnology companies and other life science enterprises that, according to Biocom. In 2023, these entities directly employed nearly 76,000 people (average annual salary: $163,177), supported more than 178,000 related jobs and generated more than $56 billion in total economic output.

The NIH and the National Science Foundation are major contributors to the region’s scientific success. In 2023, they provided $2.2 billion in overall funding.

CA-50 is the U.S. congressional district represented by Rep. Scott Peters. The district encompasses a large swath of coastal San Diego County, from Carlsbad to the U.S.-Mexico border, including La Jolla and Sanford Burnham Prebys. In 2023, according to FASEB, NIH research funding in the district exceeded $1.3 billion to 61 research sites. This year, Sanford Burnham Prebys researchers will receive more than $72 million in NIH funding.

These numbers are even greater and more impressive statewide: 466,888 Californians directly employed in life sciences and 1.24 million jobs supported for a total economic output of more than $414 billion in 2023.

No plausible or viable alternatives can match federal scientific support. Foundations and philanthropy provide only a relative fraction and their funding often comes with restrictions and little or no support for indirect costs.

Our response to the NIH action has been multi-pronged and evolving. As an institute, we are in communication with local, state and national officials to provide context, information and help them leverage their specific abilities to reverse course.

We are collaborating with our Mesa partners and with organizations like the Council on Governmental Relations, the Association of Independent Research Institutes (AIRI) and the Association of American Universities (AAU) to multiply the power of our message and influence.

We encourage those who share our commitment to scientific research to stay informed about this issue and engage with policymakers or organizations that advocate for sustained research funding.

Internally, we are assessing immediate and future effects of a 15% cut on programs and projects at Sanford Burnham Prebys, and developing plans and policies to mitigate adverse effects. This is an ongoing process that involves administration, faculty and staff.

The NIH’s policy change imperils the future of science in California and across the country, not only the continued development of life-saving therapeutics and treatments, but the training and prospering of new generations of scientists.

With a cap of 15%, fewer scientists will embrace the mission because they will lack sufficient means to do so. New generations of scientists will not have the same opportunities. The nation’s global leadership in life sciences will wither; the pipeline of new drugs, treatments and therapies will become a trickle.

No one advocates for such a future. The emergence of new tools like artificial intelligence, computational biology, machine learning and the rapid, maturing application of disciplines like epigenomics, transcriptomics and metabolomics have propelled biomedical research into a new era of unprecedented promise and potential.Our mission and vision at Sanford Burnham Prebys embraces these opportunities and possibilities to excel—and we are determined to do so.

Sincerely, David A. Brenner, MD

David A. Brenner, MD

President and Chief Executive Officer

Donald Bren Chief Executive Chair

Please send your letters to communications@sbpdiscovery.org. Letters may be edited for clarity and conciseness.

- U.S. Senators Speak: Fund the NIH A letter to Director Russell Vought at the Office of Management & Budget

- The Case for Cancer Research: A National Imperative Cosimo Commisso, PhD, Interim Director, NCI-Designated Cancer Center, Sanford Burnham Prebys

- With Research Cuts, a Troubling Prognosis Donald Kearns MD, Sanford Burnham Prebys Board of Trustees Chair and President Emeritus, Rady Children’s Hospital-San Diego

- An Early-Career Scientist Ponders an Uncertain Career Kokila Shankar, PhD, Postdoctoral Researcher, Sanford Burnham Prebys

- High School Students Ask If There’s a Future in Science—or Science in the Future Angelina Kim, Selene Wang and Anabel Weinstein, High School Students in La Jolla

- Make America Weaker Again? Peter Rowe, San Diego

- San Diego is a Biomedical Powerhouse. Let’s Keep It That Way. Terra Lawson-Remer, Vice Chair of the San Diego County Board of Supervisors

- What Do I Tell a 12-Year-old Boy Who Just Wants to Play Baseball? Rema Iyer, Doctoral Candidate, Sanford Burnham Prebys

- The ‘Irreparable Harm’ From Cuts to Scientific Funding Governing

- Congress Shows Resistance to Trump’s Plan to Slash Science Budgets Inside Higher Ed

- US federal basic research support would fall 34% under Trump proposal Chemistry World

- U.S. Budget Cuts Are Robbing Early-Career Scientists of Their Future Scientific American

- The economic effects of federal cuts to US science — in 24 graphs Nature

- Opinion: Cuts to Scientific Research Cede the Future to China Government Technology

- The potential impact of the Trump administration policies on health research in the USA The Lancet

- Trump cuts to NIH funding would gut American science and medicine | Opinion USA Today

- Comment: Trump’s science policy won’t set a ‘gold standard’ Bloomberg Opinion via HeraldNet

- Science’s reform movement should have seen Trump’s call for ‘gold standard science’ coming, critics say Science

- Indirect Cost Recovery in U.S. Innovation Policy: History, Evidence, and Avenues for Reform—A Working Paper National Bureau of Economic Research

- These scientific advances were ‘Made in the U.S.A.’ Will they continue? Washington Post

- The Bethesda Declaration: A Call for NIH and HHS Leadership to Deliver on Promises of Academic Freedom and Scientific Excellence Stand Up for Science

- Cutting the NIH—The $8 Trillion Health Care Catastrophe JAMA Health Forum

- The Trump administration’s NIH and FDA cuts will negatively impact patients Brookings Institution

- NIH Under Siege Science

- Aspiring scientists consider alternate career paths following Trump NIH cuts | Opinion The Sacramento Bee

- How we’re battling Trump’s science cuts across small-town America Nature

- US dominance in science at risk with Trump cuts, scientists warn Maryland Matters

- Undercutting the Progress of American Science Letters in The New York Times, including one from Hudson Freeze, PhD, of Sanford Burnham Prebys

- Death by a Thousand Federal Cuts: Trump Administration Actions Will Not Make America Healthy Again The Milbank Quarterly

- Grant Terminated Inside Higher Ed

- National Organizations Announce Joint Effort to Develop a New Indirect Costs Funding Model Association of Independent Research Institutes

- Cuts to science research funding cut American lives short Ohio Capital Journal

- Safeguarding the future of biomedical science in the United States Cell

- ‘America can’t be great without great science. That is where the Academies can help.’ National Academies of Sciences, Engineering, and Medicine

- AIRI Statement on Recent Disruptions to Scientific Research Association of Independent Research Institutes

- Cutting funding for science can have consequences for the economy, US technological competitiveness The Conversation

- Defend the NIH Timmerman Report

- How Cuts to NIH Research Funding Would Hurt States Center for American Progress

- California members to Trump Administration: Don’t cut NIH funding to universities Representative Linda Sanchez

- ‘What’s Going to Happen to Science?’ Inside Higher Ed

- AAMC Statement on Drastic Cuts to NIH-Funded Research American Association of Medical Colleges

- Statement of AAU President Barbara R. Snyder on Cuts to NIH Facilities and Administrative (F&A) Research Costs Association of American Universities

- APLU Statement on Cuts to Reimbursement of NIH Facilities & Administrative Costs Association of Public & Land-Grant Universities

Advocacy

How to contact government representatives and voice your thoughts

Sanford Burnham Prebys government representatives highlighted.

Federal Representatives

Find your federal senator and representative

Federal | Senate

- Adam Schiff, Democrat

- DC Office: (202) 224-3841

- Alex Padilla, Democrat

- DC Office: (202) 224-3553

- San Diego Office: (619) 239-3884

Federal | House of Representatives

- Darrell Issa, Republican, District 48

- DC Office: (202) 225-5672

- San Marcos: (760) 304-7575

- Sara Jacobs, Democrat, District 5

- DC Office: (202) 225-2040

- San Diego: (619) 280-5353

- Mike Levin, Democrat, District 49

- DC Office: (202) 225-3906

- Oceanside: (760) 599-5000

- Scott Peters, Democrat, District 50

- DC Office: (202) 225-0508

- San Diego: (858) 455-5550

- Juan Vargas, Democrat, District 52

- DC Office: (202) 225-8045

- Chula Vista: (619) 422-5963

State Legislators

Find you state senator and assembly member

Senate

- Steve Padilla, Democrat, District 18

- Sacramento Office: (916) 651-4039

- Chula Vista: (619) 409-7690

- Brian Jones, Republican, District 40